Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

Nickel 28’s growth strategy is to establish a portfolio of cash-generating streams and royalties by investing in producing assets with long mine lives, while selectively deploying capital and re-investing revenue on near-term production and development stage assets with a clear path to production of critical battery metals and the potential to deliver superior streaming and royalty returns. The Company is actively pursuing nickel and cobalt streaming and royalty opportunities that could provide shareholders with near-term revenue and cash flow, diversified asset exposure, and additional future avenues for growth.

“Significant additional mine financing will be needed over the next 10 years to meet projected nickel and cobalt production demand driven by the adoption of electric vehicles and energy storage. Existing production, mine expansion and new production will all require considerable new sources of capital, while the forecasted global supply deficit for both metals is expected to keep upward pressure on prices.”

Christopher Wallace

CEO

What is a Stream?

A metal stream is a contractual agreement whereby the purchaser makes an upfront payment in return for the right to purchase a portion of metal production from a mine. An additional per-unit payment is received by the mine owner as it delivers production.

How Streaming Works

Nickel 28 proposes to make an upfront payment plus ongoing delivery payments for a fixed percentage of future production over the life of the mine

Conceptually, streams and royalties are similar, both providing commodity price exposure with reduced capital and operating cost risk.

The stream agreement results in exposure to the streamed metal component of a mine as if it were a stand-alone operation. The purchaser benefits from any production and exploration upside, but bears any downside as well.

There are a number of benefits of streams to the mine owner:

- Significant upfront cash proceeds

- Non-dilutive form of financing

- Typically accounted for as deferred revenue not debt by the mine owner

- No fixed annual delivery obligations or covenants

- No requirement for the mine owner to change how it manages the operation

Benefits of the Stream Structure

| StreamCo | Operators | Explorers | ETF | Bullion | ||

|---|---|---|---|---|---|---|

| Exposure To | ||||||

| Metal price appreciation | ||||||

| Earnings and dividends | ||||||

| New reserves | ||||||

| Expansion potential | ||||||

| Reduced Exposure To | ||||||

| Capital costs | ||||||

| Operating costs | ||||||

| Environmental costs |

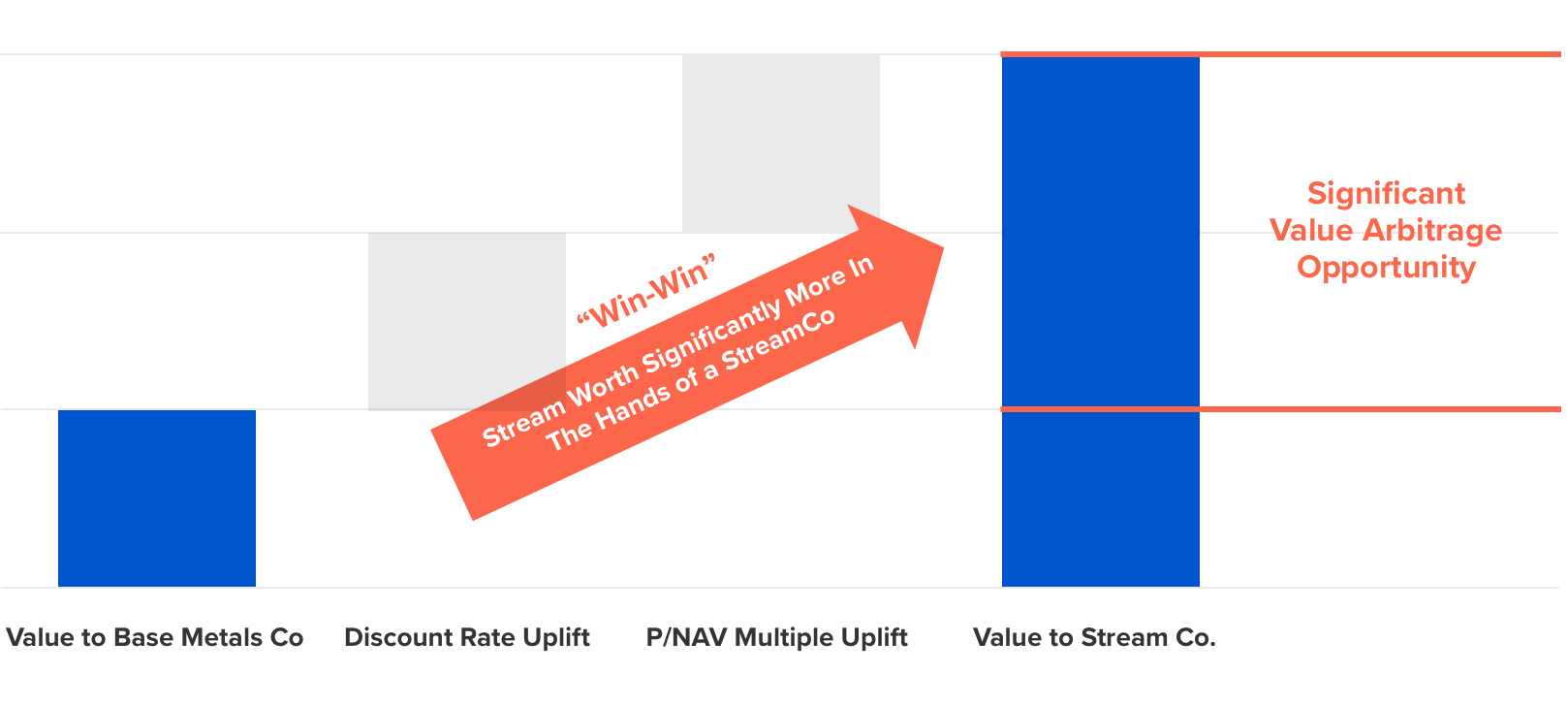

Streams Have Structural Advantages Which Support Premium Valuations

Structural Advantages of a Stream

- The structural advantages of the streaming model result in streaming companies being valued at a premium to traditional mining companies

- The opportunity for value arbitrage creating mutually accretive transactions has allowed streaming to become a mainstream financing alternative

Illustrative Arbitrage