Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

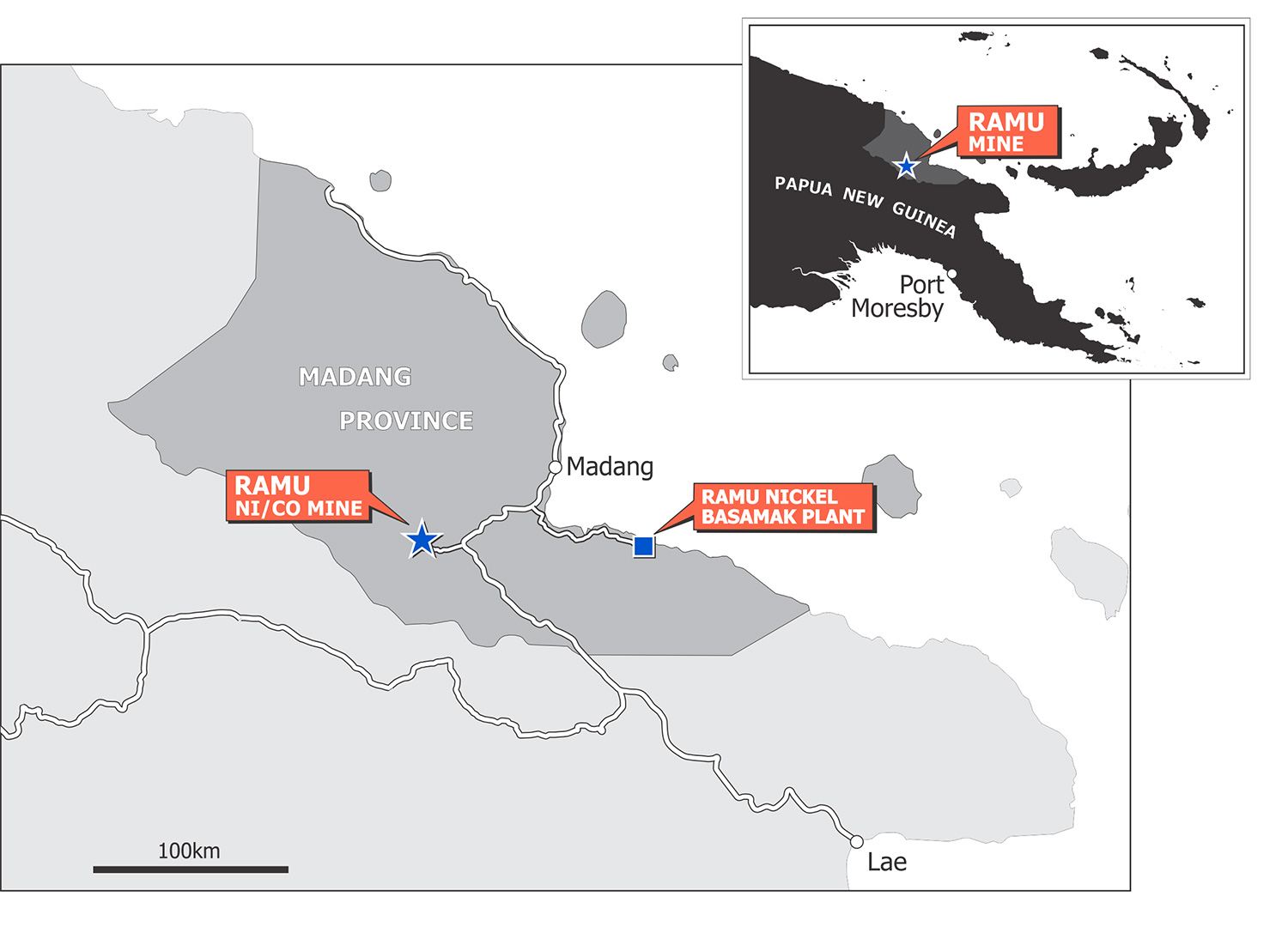

Highlands Pacific – In May 2019, Nickel 28 completed the friendly acquisition of Highlands Pacific to create a leading high-growth, diversified battery-metals investment company. Highlands’ key asset is its 8.56% interest in the long-life, world-class Ramu Nickel Cobalt Operation located near Madang on the north coast of PNG. Following repayment of Highlands’ attributable Ramu construction and development loans, Highlands’ ownership of Ramu will increase to 11.3%.

Nickel 28’ acquisition of Highlands Pacific implies an increase in attributable production to Nickel 28 to over 2,900 tonnes of nickel and over 600,000 pounds of cobalt per annum (based on 2019 Ramu production guidance for Highlands’ 8.56% interest). Upon repayment of Highlands’ attributable partner loans and increased interest in Ramu to 11.3%, implied attributable production to Nickel 28 increases to over 3,800 tonnes of nickel and over 800,000 pounds of cobalt per annum.