Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

Physical Position - 2,905.7 Tonnes Cobalt

| Operator | Cobalt 27 |

| Location | Europe & N.A. |

| Stage | Refined |

| Primary Metals | Co |

| Stream/Royalty Type | 2,905.7 tonnes |

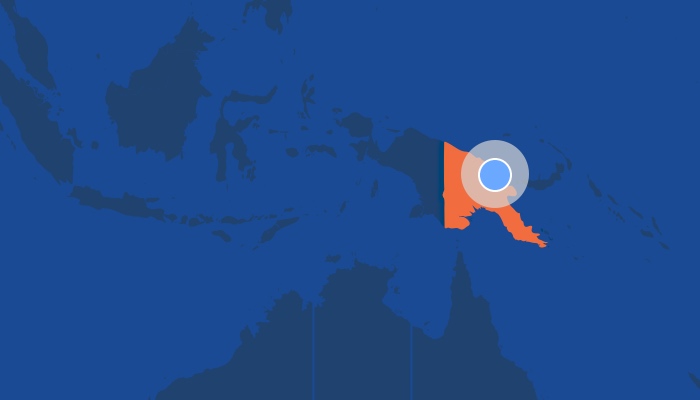

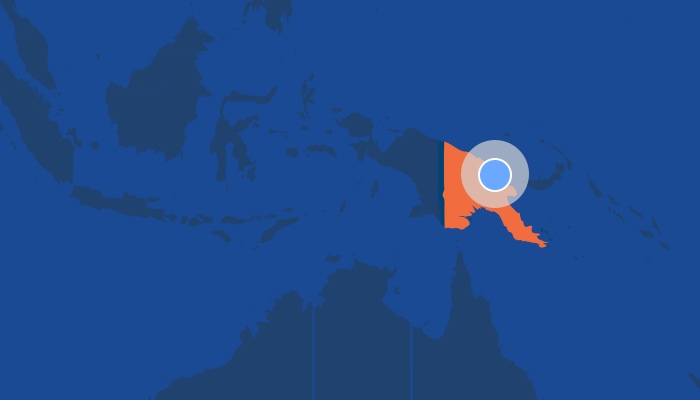

Ramu Nickel Cobalt Operation

| Operator | Metallurgical Corporation of China |

| Location | Papua New Guinea |

| Stage | Production |

| Primary Metals | Ni-Co |

| Direct Interest | 8.56-11.3% |

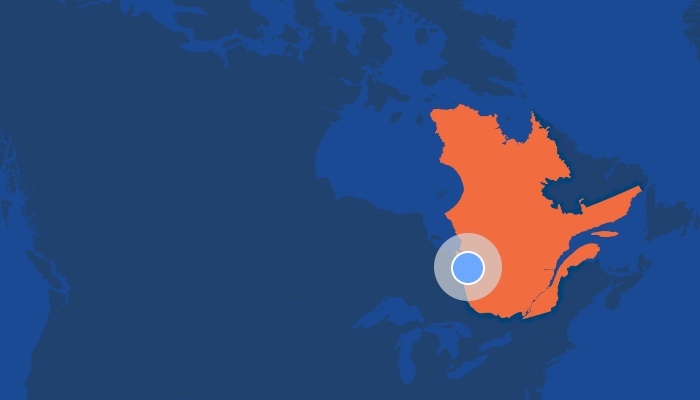

Dumont Ni-Co Royalty

| Operator | RNC Minerals |

| Location | Québec, Canada |

| Stage | Construction-ready |

| Primary Metals | Ni-Co |

| Stream/Royalty Type | 1.75% NSR |

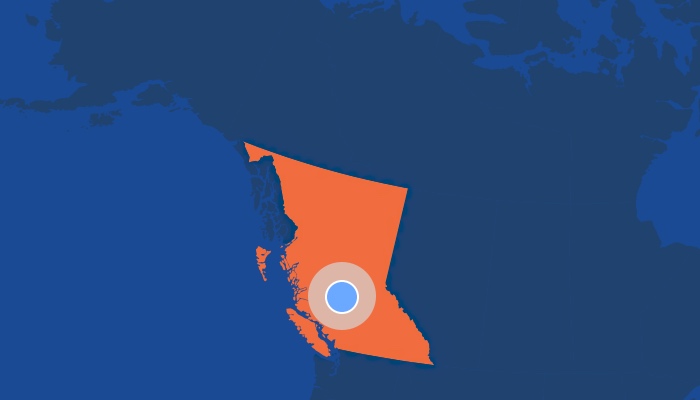

Turnagain Ni-Co Royalty

| Operator | Giga Metals Corp |

| Location | British Columbia, Canada |

| Stage | Exploration |

| Primary Metals | Ni-Co |

| Stream/Royalty Type | 2% NSR |

Flemington Ni-Co Royalty

| Operator | Australian Mines |

| Location | Australia |

| Stage | Exploration |

| Primary Metals | Co-Sc-Ni |

| Stream/Royalty Type | 1.5% GRR2 |

Nyngan Co-Sc-Ni Royalty

| Operator | Scandium Int’l Mining |

| Location | Australia |

| Stage | Construction-ready |

| Primary Metals | Co-Sc-Ni |

| Stream/Royalty Type | 1.7% GRR2 |

SEWA Bay, Nickel-Cobalt Royalty

| Operator | Pure Minerals |

| Location | Papua New Guinea |

| Stage | Exploration |

| Primary Metals | Nickel & Cobalt |

| Stream/Royalty Type | Royalty - 5% FOB GRR |

Professor and Waldman, Properties x2

| Operator | 70% Golden Deeps 30% New Found Gold |

| Location | Ontario, Canada |

| Stage | Exploration |

| Primary Metals | Cobalt & Silver |

| Stream/Royalty Type | Royalty - 2% Co NSR |

North Canol, Properties x2

| Operator | Golden Ridge Resources |

| Location | Yukon |

| Stage | Exploration |

| Primary Metals | Silver, Lead, Zinc, Cobalt |

| Stream/Royalty Type | 2% Co NSR |

Sunset

| Operator | Private Individuals |

| Location | British Columbia |

| Stage | Exploration |

| Primary Metals | Copper, Zinc & Cobalt |

| Stream/Royalty Type | 2% Co NSR |

Legend

- Direct Interest

- Metal Royalty

| Asset Name | Operator | Location | Stage | Primary Metals | Asset Type | |

|---|---|---|---|---|---|---|

| Ramu Nickel Cobalt Operation | Metallurgical Corporation of China | Papua New Guinea | Production | Nickel & Cobalt | JV Interest in Ramu Mine (8.56-11.3%) | View Asset |

| Dumont Nickel-Cobalt Royalty | RNC Minerals | Québec, Canada | Construction-ready | Nickel & Cobalt | Royalty, 1.75% NSR | View Asset |

| Turnagain Nickel & Cobalt Royalty | Giga Metals Corp | British Columbia, Canada | Exploration | Nickel & Cobalt | Royalty, 2% NSR | View Asset |

| Flemington Nickel, Cobalt & Scandium Royalty | Australian Mines | Australia | Exploration | Nickel, Cobalt & Scandium | Royalty, 1.5% GRR2 | View Asset |

| Nyngan Nickel, Cobalt & Scandium Royalty | Scandium Int’l Mining | Australia | Construction-ready | Nickel, Cobalt & Scandium | Royalty, 1.7% GRR2 | View Asset |

| SEWA Bay, Nickel-Cobalt Royalty | Pure Minerals | Papua New Guinea | Exploration | Nickel & Cobalt | Royalty, 5% FOB GRR | |

| Professor and Waldman, Properties x21 | 70% Golden Deeps 30% New Found Gold | Ontario, Canada | Exploration | Cobalt & Silver | Royalty, 2% Co NSR | |

| North Canol, Properties x21 | Golden Ridge Resources | Yukon | Exploration | Silver, Lead, Zinc, Cobalt | 2% Co NSR | |

| Sunset | Private Individuals | British Columbia | Exploration | Copper, Zinc & Cobalt | 2% Co NSR |

NSR: Net Smelter Royalty;

GRR: Gross Revenue Royalty

- Two separate mineral properties to which a Co NSR applies

Highlands Pacific

| Operator | Metallurgical Corporation of China |

| Location | Papua New Guinea |

| Stage | Production |

| Primary Metals | Ni-Co |

| Direct Interest | 8.56-11.3% |

Dumont Nickel-Cobalt Royalty

| Operator | RNC Minerals |

| Location | Québec, Canada |

| Stage | Construction-ready |

| Primary Metals | Ni-Co |

| Stream/Royalty Type | 1.75% NSR |

Turnagain Nickel & Cobalt Royalty Costs

| Operator | Giga Metals Corp |

| Location | British Columbia, Canada |

| Stage | Exploration |

| Primary Metals | Ni-Co |

| Stream/Royalty Type | 2% NSR |

Flemington Nickel, Cobalt & Scandium Royalty

| Operator | Australian Mines |

| Location | Australia |

| Stage | Exploration |

| Primary Metals | Co-Sc-Ni |

| Stream/Royalty Type | 1.5% GRR2 |

Nyngan Nickel, Cobalt & Scandium Royalty

| Operator | Scandium Int’l Mining |

| Location | Australia |

| Stage | Construction-ready |

| Primary Metals | Co-Sc-Ni |

| Stream/Royalty Type | 1.7% GRR2 |

SEWA Bay, Nickel-Cobalt Royalty

| Operator | Pure Minerals |

| Location | Papua New Guinea |

| Stage | Exploration |

| Primary Metals | Nickel & Cobalt |

| Stream/Royalty Type | Royalty - 5% FOB GRR |

Professor and Waldman, Properties x21

| Operator | 70% Golden Deeps 30% New Found Gold |

| Location | Ontario, Canada |

| Stage | Exploration |

| Primary Metals | Cobalt & Silver |

| Stream/Royalty Type | Royalty - 2% Co NSR |

North Canol, Properties x21

| Operator | Golden Ridge Resources |

| Location | Yukon |

| Stage | Exploration |

| Primary Metals | Silver, Lead, Zinc, Cobalt |

| Stream/Royalty Type | 2% Co NSR |

Sunset

| Operator | Private Individuals |

| Location | British Columbia |

| Stage | Exploration |

| Primary Metals | Copper, Zinc & Cobalt |

| Stream/Royalty Type | 2% Co NSR |