Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

EVs – A look at the Big Players and Timelines

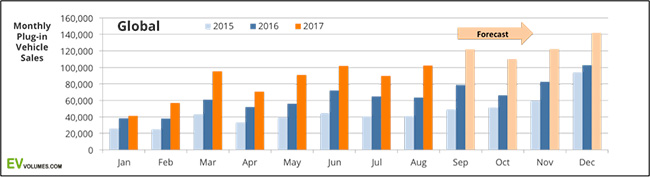

Electric vehicles (EVs) are currently the primary growth driver of battery metal demand. That’s a good thing because global EV sales are climbing fast, with volumes more than tripling since 2013. According to the EV World Sales Database website, if last year’s growth rate of 42% continues, then 80% of new vehicles sales will be electric by 2030.

Personally, I think the EV adoption rate will accelerate, considering the strength of world-wide, government support for EVs. Did you know, for example, that Norway plans to ban all gas-powered cars by 2025, that the Dutch to ban sales of new gas-powered cars by 2030 and that many others, such as the UK and France are lining up to follow suit? China has already put aggressive EV sales quotas and subsidies in place and similar approaches are being taken by other countries.

It’s clear that EVs are not just here to stay, they are here to supplant the gas-powered vehicles that we’ve been driving for decades. Importantly for those of us in the battery metals sector, this transition is happening far quicker than a lot of people realize and anticipated.

Who are the major players behind all these EV sales? When most people think EV’s, they think Tesla because, let’s face it, Tesla has a spectacular marketing machine and demand for its vehicles blew past expectations. In fact, early demand for Tesla cars was so great that the global automakers didn’t just sit up and take notice, they took action. A look at recent sales by make and model shows us who the major players are in the current EV market.

| Make and Model | 2017, Q2 | 2017, H1 | Change YoY |

| Toyota Prius Prime PHEV | 15,935 | 26,494 | - |

| Zhi Dou D1/D2 EV | 12,894 | 18,717 | +445% |

| Tesla Model S | 11,872 | 27,014 | +21% |

| Nissan Leaf EV | 11,484 | 26,785 | -3% |

| BJEV EC180 | 10,810 | 17,939 | - |

| Tesla Model X | 9,915 | 21,759 | +204% |

| BYD e5 EV | 8,849 | 10,856 | +189% |

| BMW i3 EV / EREV | 8,033 | 15,862 | +73% |

| Renault Zoe EV | 7,981 | 17,180 | +45% |

| JAC iEV6S EV | 7,014 | 8,023 | +332% |

| BYD Song PHEV | 6,838 | 6,838 | - |

| Mitsubishi Outlander PHEV | 6,624 | 12,873 | -17% |

| Chevrolet Volt EREV | 6,501 | 13,018 | +17% |

| Geely Emgrand EV | 6,079 | 7,982 | +110% |

| SAIC Roewe eRX5 PHEV | 5,988 | 9,205 | - |

| Chery eQ EV | 5,485 | 6,605 | +24% |

| Chevrolet Bolt EV | 5,315 | 8,740 | - |

| BYD Tang PHEV | 4,696 | 7,502 | -61% |

| Changan Benni EV | 4,656 | 6,064 | - |

| VW e-Golf EV | 3,846 | 5,711 | +6% |

| Zotye E200 EV | 3,783 | 5,949 | +158% |

| BMW 330e PHEV | 3,779 | 7,240 | +118% |

| Hyundai Ioniq Electric EV | 3,564 | 6,057 | +4196% |

| Mercedes GLC350e PHEV | 3,467 | 5,997 | +1521% |

| Audi A3 e-Tron PHEV | 3,346 | 6,467 | +18% |

| Others | 84,721 | 150,137 | -5% |

| TOTAL | 263,565 | 457,014 | +44% |

Toyota, China’s Zhi Dou, Tesla, Nissan, BMW, Chevrolet, Mitsubishi, Volkswagon Mercedes… most of the big automakers have a place on the list and that’s critical because without them, global penetration wouldn’t be possible.

It’s important to bear in mind that the EV market is notable for how fast it’s moving. For example, Volvo doesn’t make a showing on the top 25 table, however, this Summer the company announced that by beginning of 2019, all new Volvos would be electrified. Considering that Volvo sells over half a million vehicles per year, that’s a lot of new EV’s soon to be on the road.

Then you have Ford, which sells over 6.7 million vehicles a year, spending $4.5 Billion to develop thirteen new EV models. By 2020, Ford expects around 40% of it’s new vehicles will be electrified, including pick ups, sports cars, SUVs and sedans.

Even bigger than Ford is GM, which sells over 10 million vehicles a year and has clearly stated that it believes the future is “all electric”. To ensure its leading position as an automaker in the electric future, GM is planning 20 EV models by 2023.

While current global EV numbers are close to three million – a small percentage of the 1.5 Billion vehicles as a whole – most of these were sold during the last few years. Between government legislation, consumer demand and rapid action from automakers, there can be no doubt that EV dominance is purely a matter of time and that time is coming soon.

Anthony Milewski, Chairman of Nickel 28

About Anthony Milewski

Mr. Anthony Milewski has spent his career in various aspects of the mining industry, including as a company director, advisor, founder and investor. In particular, he has been active in the commodities related to decarbonization and the energy transition, including nickel, cobalt, copper and carbon credits. Anthony has served on the London Metals Exchange Cobalt Committee, which includes representatives from the largest mining and commodities companies globally, to represent the interests of the industry to the board of directors the LME. Mr. Milewski holds a B.A. in Russian history from Brigham Young University, an M.A. in Russian and Central Asian Studies from the University of Washington, and a J.D. from the University of Washington. Anthony Milewski has been interviewed by numerous Media outlets, including BNN, The Financial Times, Bloomberg, The Northern Miner and many others. Most recently, Anthony Milewski has written op-ed articles for leading mining publications including The Northern Miner.

Forward-Looking Information: Some of the posted entries on the CEO Corner may contain forward-looking statements. Forward-looking statements address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. Examples of forward looking information and assumptions include future estimates of the worldwide supply and demand for nickel and other metals and the effect that these changes could have on the short term and long term price of nickel and other metals on the world markets, statements regarding the future operating or financial performance of Nickel 28 including the net present value, metal recoveries, capital costs, operating costs, production, rates of return and payback. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com.

In some cases, forward-looking statements can be identified by terminology such as "may", "will", "should", "expect", "projects", "plans", "anticipates" and similar expressions. These statements represent management's expectations or beliefs concerning, among other things, future operations and various components thereof affecting the economic performance of Nickel 28. Undue reliance should not be placed on these forward-looking statements which are based upon management's assumptions and are subject to known and unknown risks and uncertainties, including the business risks discussed above, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Accordingly, readers are cautioned that events or circumstances could cause results to differ materially from those predicted.

Links: Some of the posted entries on the CEO Corner may include links to 3rd party websites. Nickel 28 has not reviewed all websites linked to or from this Site and is not responsible for the contents of any such websites. The inclusion of any link does not imply endorsement by Nickel 28 of the linked website or its content. Use of any such linked website is at the user's own risk.

For further information we refer you to our legal notice.