Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

Nickel: short-term pain, long-term gain

The price of nickel has fallen and sitting around $16,000 per tonne in early 2024, down 40% from 2023, due to a surplus of supply and economic downturn. And almost all the forecasts expect the surplus to continue for at least another 2-3 years.

But, what if the forecasts are wrong?

Can the low price itself act as a catalyst for higher prices by shutting down supply. Low prices are a cure for low prices.

The list of nickel mines closing is increasingly long, for example:

- Glencore is placing it’s Koniambo Nickel SAS (KNS) mine in New Caledonia on care and maintenance

- Anglo American booked a write-down of $800mn for its Barro Alto nickel mine in Brazil

- First Quantum Minerals ceased new mining at its Raventhorpe mine in Australia

- Wyloo Metals will close it’s Australian Cassini and Northern Operations nickel mines

- production has been halted at Panoramic’s Savannah nickel mine in Western Australia

- Avebury, wholly owned by Mallee Resources, in Tasmania is set to close

- Australian battery metal producer IGO Ltd will put its Cosmos nickel project in Western Australia into care and maintenance

- BHP Group is reassessing the value of its nickel operations

- Both Goro and Doniambo in New Caledonia have indicated that without new funding their future may not be assured

Nickel production in Australia and New Caledonia accounts for approximately 13% of global supply. And import restrictions on Russia nickel into the West (such as sanctions and duty tariffs) are also impacting another 9% of supply.

Current low prices are also impacting future investment in the sector, with exploring and developing new mines less attractive.

In Indonesia, for example, Nanjing Hanrui Cobalt has announced it will halt its new high-pressure acid leach (HPAL) project, which had a projected capacity of 60,000 tonnes of nickel content.

And, at the end of 2023, the US Department of Treasury released its definition of a Foreign Entity of Concern (FEOC) for the purposes of the Inflation Reduction Act (IRA), threatening to cut Indonesian nickel out of US electric vehicle tax credits.

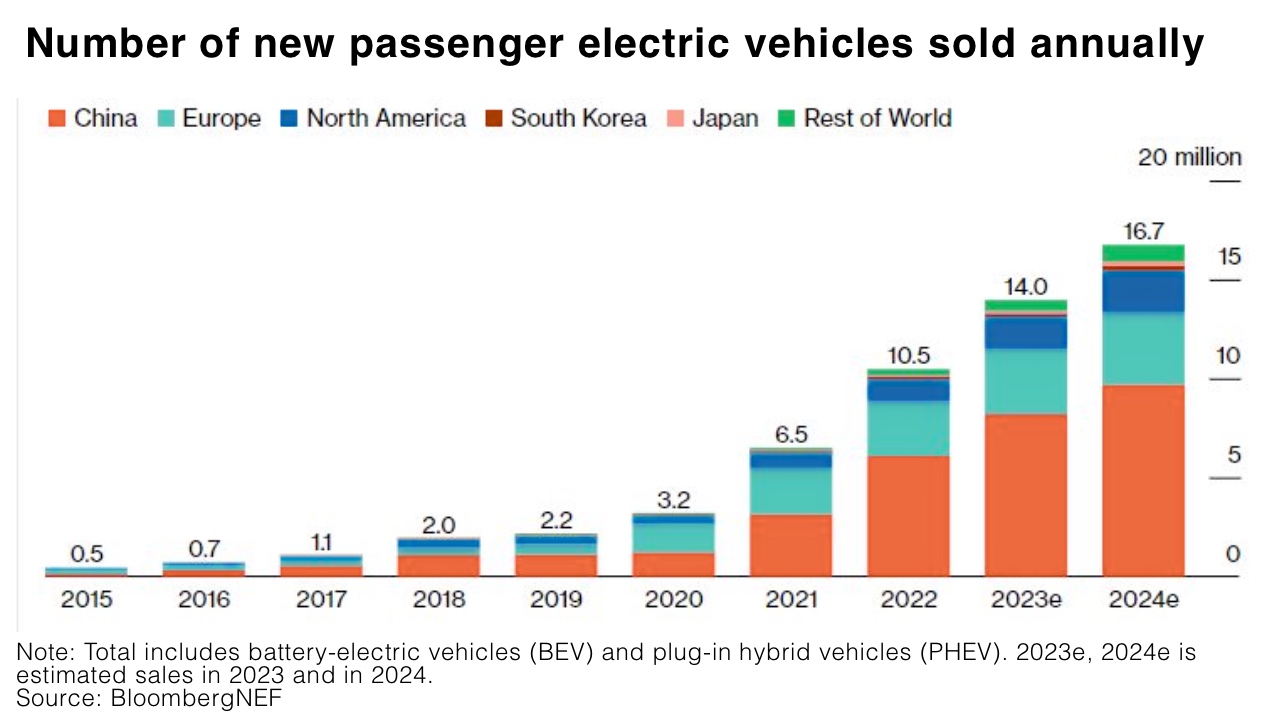

However, the growth sector for nickel — renewable energy and electric vehicles (EVs) — is set for continued strong growth. BloombergNEF estimates global EV sales are set to increase from 14 million in 2023 to 16.7 million in 2024.

Production in Indonesia has, so far, proved more resilient, with the downturn providing the country the opportunity of potentially expanding its dominant role in global supply from 55% in 2023 to more than 70% in the next five years, according to analysts.

“If we see a lot of non-Indonesia projects go to the wall, then Indonesia’s share goes even higher,” according to Jim Lennon, commodity strategy consultant at Macquarie Bank. “At the moment, there is no alternative. There is no big source being developed or approved elsewhere.”

While the immediate impact of low prices might be mine closures and production cuts, their longer-term effect could be a more balanced and stable market. By removing high-cost producers and discouraging speculative investments, low prices can pave the way for a more efficient and resilient supply chain.

Forward-Looking Information: Some of the posted entries on the CEO Corner may contain forward-looking statements. Forward-looking statements address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. Examples of forward looking information and assumptions include future estimates of the worldwide supply and demand for nickel and other metals and the effect that these changes could have on the short term and long term price of nickel and other metals on the world markets, statements regarding the future operating or financial performance of Nickel 28 including the net present value, metal recoveries, capital costs, operating costs, production, rates of return and payback. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com.

In some cases, forward-looking statements can be identified by terminology such as "may", "will", "should", "expect", "projects", "plans", "anticipates" and similar expressions. These statements represent management's expectations or beliefs concerning, among other things, future operations and various components thereof affecting the economic performance of Nickel 28. Undue reliance should not be placed on these forward-looking statements which are based upon management's assumptions and are subject to known and unknown risks and uncertainties, including the business risks discussed above, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Accordingly, readers are cautioned that events or circumstances could cause results to differ materially from those predicted.

Links: Some of the posted entries on the CEO Corner may include links to 3rd party websites. Nickel 28 has not reviewed all websites linked to or from this Site and is not responsible for the contents of any such websites. The inclusion of any link does not imply endorsement by Nickel 28 of the linked website or its content. Use of any such linked website is at the user's own risk.

For further information we refer you to our legal notice.