Nickel 28 Capital Corp.

Suite 5300, TD Bank Tower,

Box 48, 66 Wellington Street West, Toronto, ON M5K 1E6

info@nickel28.com

Transaction Highlights

Creation of a leading high-growth, diversified battery metals streaming and royalty company

Increases exposure to a large, long-life, low cost, high-growth nickel-cobalt mine (Ramu)

Expands and diversifies existing portfolio with increased nickel exposure

Accretive to Conic Metals shareholders

Attractive re-rating potential

Repayment of Ramu loans after closing will accelerate cash flow to Conic Metals

Transaction Details

Transaction Summary

- Total transaction value of US$70 million, of which US$61 million is anticipated to be funded with cash consideration(1)

Consideration

- Base Purchase Price: All-cash consideration of A$0.105 per share of Highlands Pacific Limited (“Highlands”) that is not already owned by Conic Metals or by PanAust Limited (“PanAust”) (see below)

- Represents a premium of 44% to Highlands’ closing price on December 24, 2018 and 30% premium to the 20-day VWAP

- Contingent Consideration: A$0.010 per share if before December 31, 2019 the LME official closing cash settlement price for nickel is US$13,220 per tonne or higher for a period of 5 consecutive trading days

PanAust Buy-Back Agreement

- PanAust would transfer to Highlands legal and beneficial ownership of 128,865,980 Highlands shares currently held by PanAust, and agree to the cancellation of any outstanding liabilities owed by Highlands to PanAust, in return for Highlands transferring to PanAust all of the shares in Highlands Frieda Limited and an estimated US$0.3 million in cash

Form of Deal

- Scheme of Arrangement under Part XVI of the PNG Companies Act in Papua New Guinea (the “Scheme”)

Conditions

- The Scheme will require approval by the requisite majority of Highlands’ shareholders under the PNG Companies Act(2)

- Customary regulatory and court approvals

Other

- The directors of Highlands (other than Anthony Milewski, because Anthony is also Chairman and CEO of Conic Metals) have stated that they intend to vote shares that they own in favour of the Scheme in the absence of a superior proposal

- Shareholders holding in aggregate of approximately 30% of Highlands’ shares outstanding have stated an intention to vote in favour of the Scheme, in the absence of a superior proposal

- Comprise PanAust, funds associated with LIM Advisors Limited, and Tribeca Investment Partners Pty Ltd.

- Reciprocal termination fees of A$1 million applicable in customary circumstances

Anticipated Timeline

- The transaction is expected to close in Q2 2019

Footnotes

- Assumes PanAust Buy-Back Agreement is completed

- PanAust is ineligible to vote on the Scheme of Arrangement

Overview of Key Transaction Benefits to Conic Metals Shareholders

Consistent with strategy of gaining exposure to battery metals

Greater nickel and cobalt exposure

Lower transaction cost

Significantly lower pro forma debt

Increased exposure to low-cost, long-life Ramu mine

Expands and diversifies existing portfolio with increased nickel exposure

Accretive to shareholders on a NAV basis(1)

Superior platform in Australasia to review and invest in regional opportunities

Simplifies the ownership and future funding mechanism for Ramu

Footnotes

- Based on street NAV estimates

Highlands Pacific Overview

Corporate Overview

- Highlands Pacific (“Highlands”) is an ASX-listed battery metals producer and developer

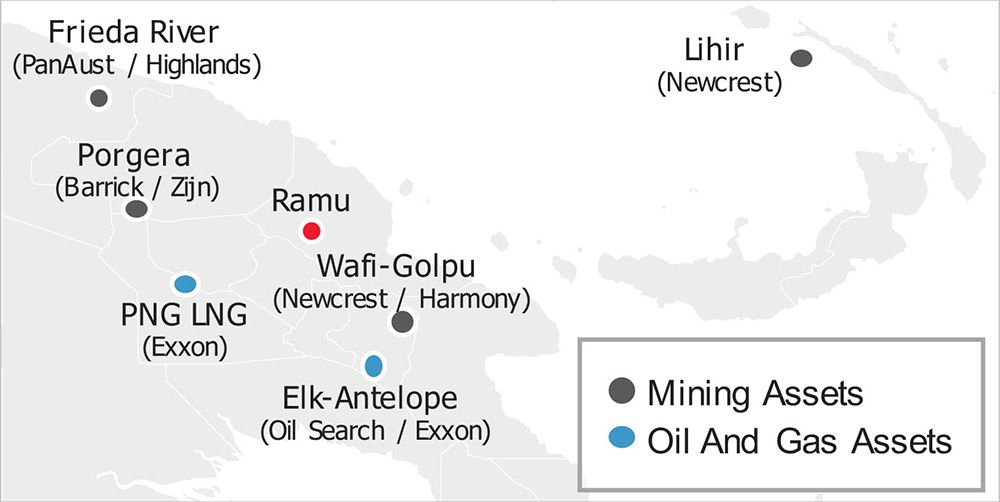

- Primary assets are an 8.56% interest in the Ramu Mine and a 20% interest in the Frieda River Copper-Gold Project, both located in Papua New Guinea

- Ramu interest will increase to 11.3% upon repayment of partner loans to MCC

- Also holds interests in the Star Mountains copper-gold exploration project and the Sewa Bay laterite nickel project in PNG

- Ramu partner loans are non-recourse and have a balance of US$115 million(1)

Ramu Expansion

- Ramu’s operator, the Metallurgical Corporation of China (“MCC”), is investigating a ~US$1.5 billion expansion of the mine

- Conic Metals will have the opportunity to participate in the expansion and increase its attributable production

Non-core Assets

- The proposed transaction entails the sale of Highlands’ interest in Frieda River to PanAust

- Conic Metals to acquire interests in Star Mountains and Sewa Bay and will evaluate strategic alternatives

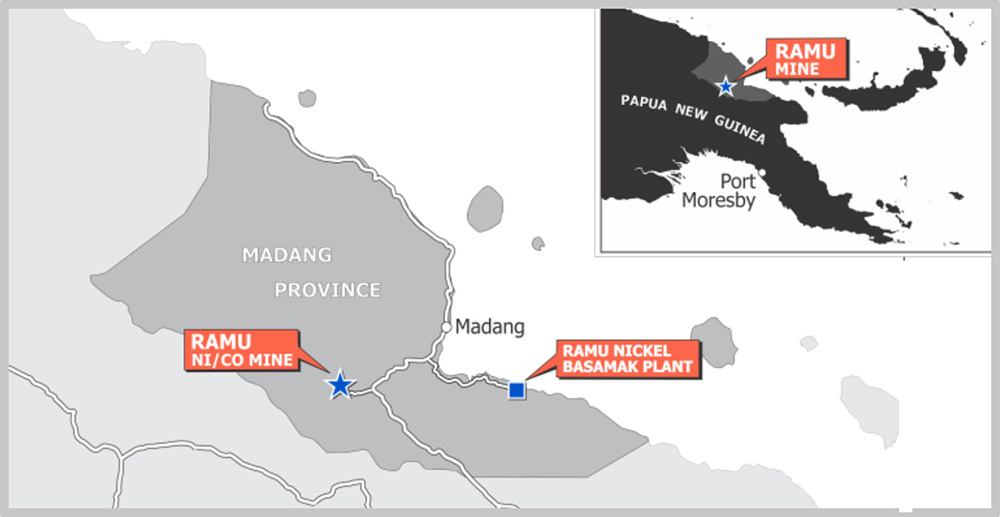

Asset Locations

Footnotes

- As at June 30, 2018

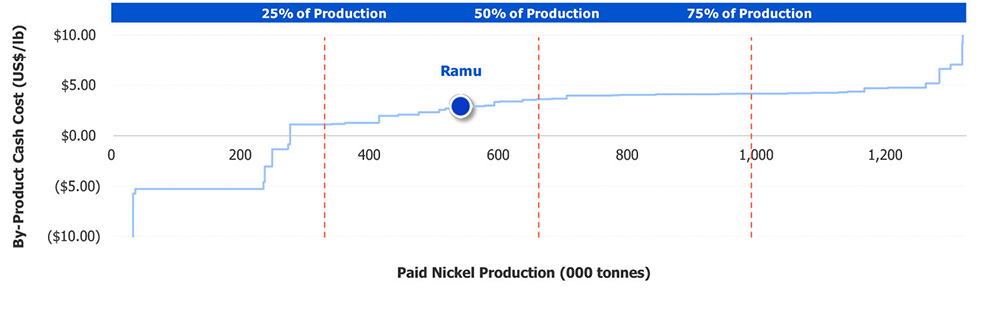

Ramu Overview

- Ramu is a producing, open-pit nickel-cobalt mine located on the coast of the Bismark Sea in the Madang Province of Papua New Guinea (“PNG”)

- In 2017, PNG’s total population was ~8.3 million and its total GDP was ~US$21 billion

- Constructed in 2008 and commissioned in 2012 with ~US$2.1 billion in capital expenditures invested

- Joint venture between the following:

- Metallurgical Corporation of China Ltd. (85% ownership) – Operator

- Highlands (8.56% ownership, Highlands has the option to repay the partner loans and increase its ownership to 11.3%)

- PNG Government and local landowners (6.44% ownership, have the option to repay partner loans and increase its ownership to 8.7%)

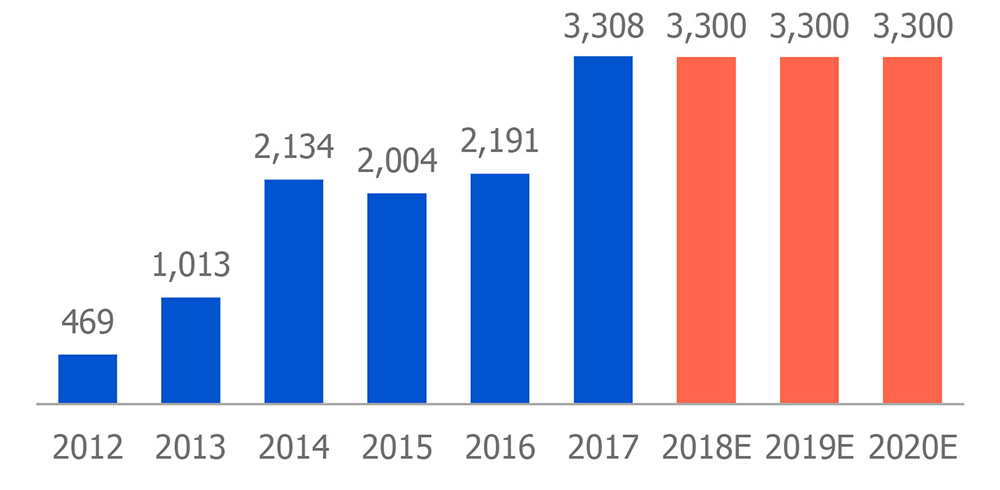

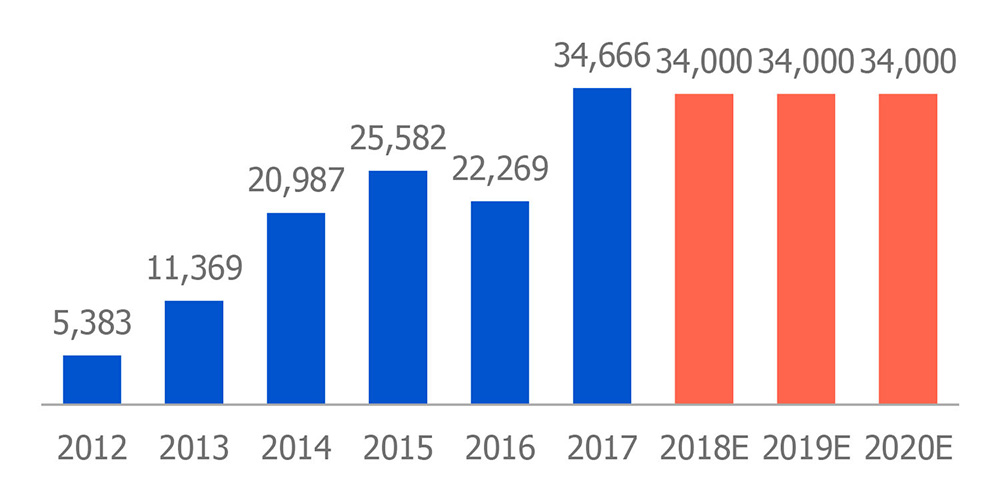

- 2018 forecast production of 3,300 tonnes of cobalt and 34,000 tonnes nickel (in concentrate)

- Now achieving record production rates

- Potential to deliver 30+ years of mine life

- Resource: 136 Mt(1) @ 0.9% Nickel and 0.1% Cobalt

- Reserve: 56 Mt @ 0.9% Nickel and 0.1% Cobalt

Images (click to view larger)

Footnotes

Source: World Bank, Highlands

- Resources are inclusive of reserves